Criteria for Admission to the Master of Accountancy Program

1. Evidence of a bachelor’s degree in any field from a U.S. regionally accredited post-secondary institution with a cumulative grade point average of at least 2.75 on a 4.0 scale.

2. Evidence of completion of the Background Curriculum for Master of Accountancy listed below or visit with the Carroll College graduate admission counselor about the bridge curriculum .

3. Graduate application and official transcripts per Carroll College Graduate Admissions.

4. Recommend Graduate Management Admission Test (GMAT) or Graduate Record Exam (GRE) (with score converted to comparable GMAT) score of at least 430. The GMAT or GRE is waived for the following applicants:

- Professionals with 5 or more years of experience.

- Accounting majors with an overall GPA of at least 3.00 on the last 60 credits.

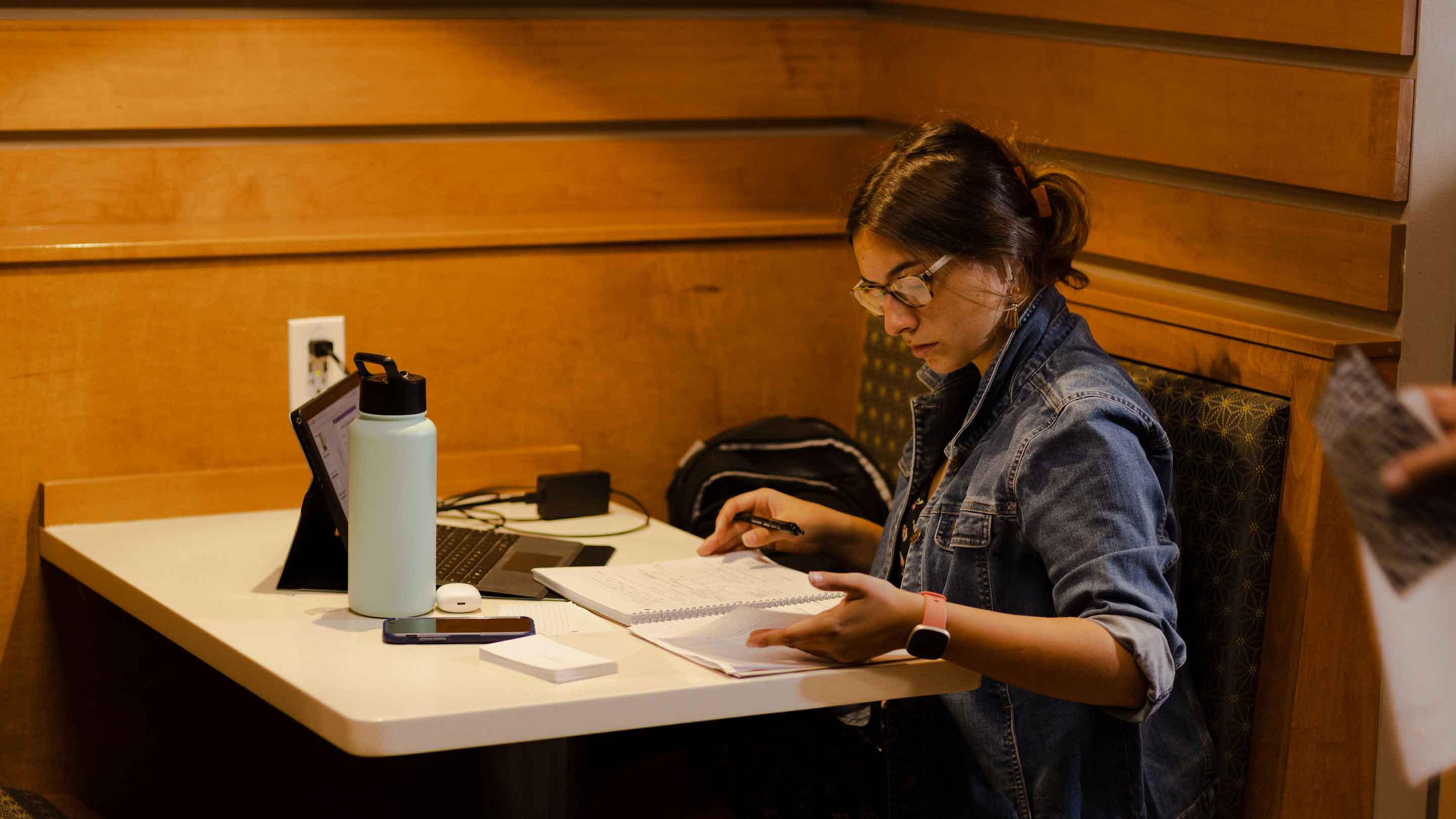

5. Students may enroll either full-time or part-time in the Master of Accountancy program.

(Note: Graduate students may transfer in a maximum of 6 graduate semester credits earned at a regionally accredited college or university within 5 years of admission to Carroll College. A “B-” or better must have been earned in the coursework. Please refer to Carroll College’s Graduate Programs Bulletin for additional information.)